The Alberta Living Wage Network calculates a modest budget to determine the necessary hourly wage for a number of Alberta communities

Author of the article:

Published Nov 16, 2022 • 4 minute read

Article content

As many Calgary households grapple with the effects of inflation and grocery prices on their monthly budgets, the living wage for residents across Alberta has increased over the past year.

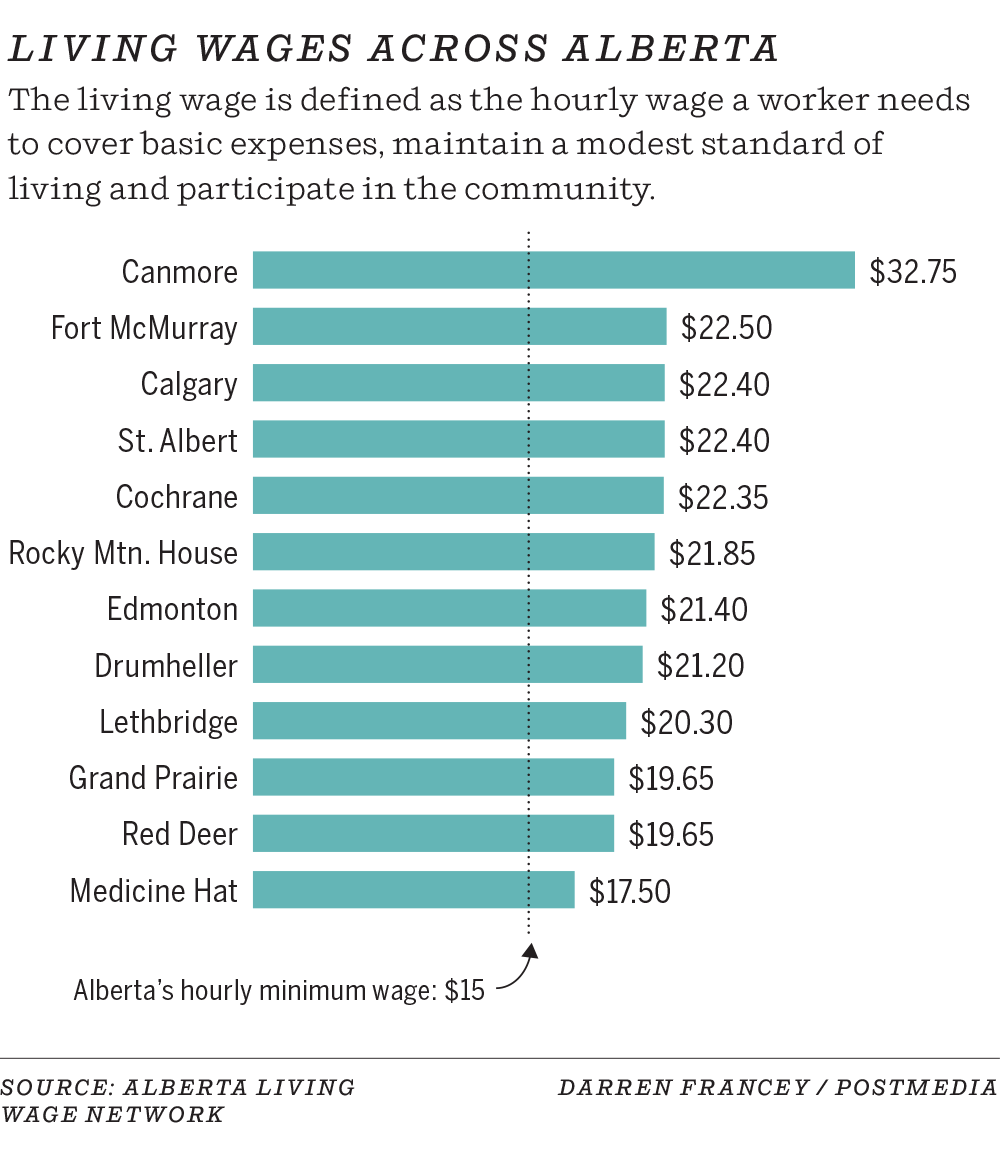

The Alberta Living Wage Network — a group of community organizations and municipalities — calculates a modest budget to determine the necessary hourly wage for a number of Alberta communities, which includes conservative estimates for basic expenses such as gas, electricity and food.

The living wage for Calgarians increased from $18.60 in 2021 to $22.40 this year.

“A living wage is not a luxurious lifestyle. A living wage gets you to a place where you’re not trading out your basic needs to survive,” said Meaghon Reid, executive director of Vibrant Communities Calgary.

“This shows us what we’re all experiencing. Everything is getting more expensive and it’s getting a lot harder to stretch a dollar for an average Calgarian.”

While the living wage in the mountain town of Canmore has decreased since it was last updated, it remains the highest in the province at $32.75 — down from $37.40 the year before.

According to the town, a 2018 survey showed that basic household expenses in Canmore were on average 43 per cent more expensive than Alberta’s baseline. Specifically, housing in Canmore was found to be 141 per cent higher than Alberta’s baseline.

Lisa Brown, Canmore’s manager of community social development, said in a news release that the living wage data puts into context the affordability concerns of many Albertans.

“This is a tool and calculation that helps us to understand what expenses impact the cost of living within our communities, as well as helping us to identify what programs increase affordability for our residents,” said Brown.

Also in the Calgary area, Cochrane’s living wage was calculated at $22.35, Drumheller was $21.20 and Rocky Mountain House was $21.85. In Lethbridge, the living wage this year is $20.30, it sits at $19.65 in Red Deer and is cheapest in Medicine Hat at $17.50.

The Alberta Living Wage Network adjusts its calculations to reflect the lived reality of Albertans, based on the income needs of a two-parent family with two young kids, a lone-parent family with one child, and a single individual living alone.

The network said the intention of releasing the living wage numbers is to highlight the reality of the cost of living in Alberta communities.

Reid said the updated data highlights the need for government intervention to make life affordable for Albertans. The minimum wage in Alberta sits at $15, which means many people are earning well below the necessary income.

“We hear from people that there are a lot of trade-offs in terms of basic needs if you’re not at that living wage. People have said they have to skip meals in order to make rent,” said Reid, adding that they’ve also heard from seniors who are rationing medications to cut prescription costs.

She said it’s also important that employers realize their role in this, and said it’s time that big corporations pay employees living wages.

“Small and medium local businesses have really been shouldering the living wage burden for far too long. We need to talk about why grocery chains that have made record profits in the last couple of years aren’t paying a livable wage,” said Reid.

Government policies that boost affordability, such as the child tax benefit, help to bring the living wage down, Reid said.

Alexander David, professor of finance at the University of Calgary’s Haskayne School of Business, said lower-income households are struggling to make ends meet.

David said the rise in food prices, caused in part by supply chain issues and international conflict, was expected to be temporary but continues to affect consumers, and likely will continue in 2023.

“That is worrisome for people making minimum wage,” he said.

Canada’s annual inflation rate remained steady at 6.9 per cent last month, according to Statistics Canada, following a several-month decline since it peaked in June at 8.1 per cent. Meanwhile, wages were up only 5.6 per cent in October compared to a year ago.

Interest rates have been raised by the Bank of Canada six times since March in an effort to stop rising inflation. The next interest rate decision is set for December.

Despite inflation still being uncomfortably high, David said it is mildly positive that it didn’t go up in October.

“In an ideal world, the minimum wage should be indexed to inflation but businesses have also been struggling since the pandemic. Some would argue that if you increase the minimum wage, many businesses would go under, which would make the economic situation worse,” he said.

“The Bank of Canada is trying to raise interest rates to moderate demand with the hope that will eventually cool off prices . . . It’s never been easy to cool off inflation of six or seven per cent down to two per cent without causing a recession.”

He said there’s a glimmer of hope that some of the supply chain issues might be easing, which would mean fewer disruptions and potentially reduce prices, he added.

Anyone in need of immediate financial assistance can call 211, a 24/7 service that refers people to emergency support.

Reid encourages people to donate if they can and look for signs of distress among their neighbours and friends in order to offer help or connect them with services.